Fiscal stimulus is an attempt to influence the country's economy through public expenditures and public revenues. As mentioned in the first lecture Keynesians blame animal instincts of the economic slowdown during the recession, in other words, a manic-depressive consumer who got into a depressive phase and irrationally refuses to buy. His restraint reduces aggregate demand, the sum of all individual demands in the economy. The reduced aggregate demand, according to this theory leads to overcapacity in the economy (production running at full speed, holiday homes in Spain are empty, or accrue) and unemployment. Therefore, the state should enter the scene and support either aggregate demand growth in public spending or a decrease in public revenues, both through government deficits, i.e. with a loan. The loan should then be repaid by government surpluses in good times.

The theory is that such borrowed and spent Euros will get into the hands of people who will start thereof to purchase goods and services again leading to GDP growth, employment growth, and economic activity. During downturns, it is important to spend money the state does not have and there is no difference on what. Even if the money will be used to pay workers, of whom first group digs empty pits just to be buried by the second. It's supposedly better than no stimulation. From this theory follows, that the best thing which could happen for world economy today would be a real threat of attack by aliens. Ludicrous? These are not my words but of probably best known today Keynesian awarded Nobel prize in economics Paul Krugman.

But what will happen to all fortifications and weapons in case the aliens finally will not attack? They will remain abandoned, unmarketable, and unusable - a huge amount of capital unnecessarily spent on useless things. In other words, the market bubble will burst on a market for defence against alien attacks. Does not it remind you the real estate market in the USA and Spain and what happened on these markets after the last bubble burst caused by monetary illusion? Ironically, Krugman in 2001 called for the U.S. central bank to establish bubble in U.S. real estate market with the help of monetary illusion itself in the fight against the recession. It succeeded. The whole world carries the consequences to this day.

The list of reasons why I have a problem believing that public expenditure on debt will help the economy is long:

- The economy is not a car. Civil servants did not invent the economy and do not know how it "operates", therefore they cannot fix it. The economy is not a machine or commodity. The economy is emergent phenomenon. We all are the economy.

- The problem is not lack of demand, but lack of funds, from which the demand can be financed. People are still willing to ride in expensive cars, eat, drink, have fun, travel on nice holidays, buy wedding rings, go on a date to the cinema, in other words to live. But they can finance this demand no longer, given the lack of capital wasted on useless projects due to previous monetary illusion (Burj Khalifa, empty houses in the U.S., Spain, Ireland, consumption financed by unsustainably high salaries of civil servants in Greece). The claim that the reason of the crisis is the animal instincts moves solution to the real crisis nature on psychiatrists and mystics.

- Parable of the broken window by Bastiat. Important is not only what is seen (GDP), but also what at first sight when stimulated through public spending is not seen (decreased demand of those who finance the growth and unsustainable change of production structure). Let us show it on scrap subsidy. State borrows so people destroy their operating vehicles and buy new ones. Where does it borrow? What would be with that money if the state does not borrow? Isn’t this capital missing somewhere else now? What would people buy if they did not buy new cars? Aren’t these scrapped cars missing? It is a redistribution of wealth and also distortion of the economy, which will have to re-adjust to the reality as soon as the stimulus ceases. And it costs a lot of money and it's a waste of resources.

- This theory ignores the failure of the state and actual functioning of the political process. This is manifested for example as an allocation inability. It is a mystery how such U.S. fiscal stimulus in the form of spending on "green energy" will help to use excess capacity on the labour market in civil engineering sector. In addition to the fact, that politicians are not able or qualified and motivated to spend borrowed money productively, statement that the recession deficits will be repaid in good times is just a sweet lies. Just look at the economy of Slovakia. Politicians have not been able to manage in a balanced manner (let alone manage a surplus!) even during the "Chinese" growth of Slovak economy.

The surplus in good times GDP growth (left axis) public deficit as % of GDP (right axis)

GDP growth (left axis) public deficit as % of GDP (right axis)

- And it certainly is not a Slovakian specificity; the euro area as a whole did never operate with surplus during last 15 years! The only chance is to grow from the debts with a massive economic growth, which is, however, rare in the developed world. Debts will keep growing, leading once to the states bankruptcy; i.e. what is happening today. Why the theory of fiscal incentives is so extremely popular among politicians always during a crisis (despite it has already been theoretically and empirically challenged many times) is obvious. If you were a politician in a recession, which economist would you listen to - the one who says, "Spend what you can thus helping the economy" or the one who says, "It is necessary to be thrifty and make unpopular measures!"

- People are not completely stupid. In particular, entrepreneurs know today’s huge deficits shall be paid once and therefore calculate with the fact that de facto today’s deficits are tomorrow’s high taxes. Therefore, businesses today are investing less (and people consume less), which counteracts the economic growth.

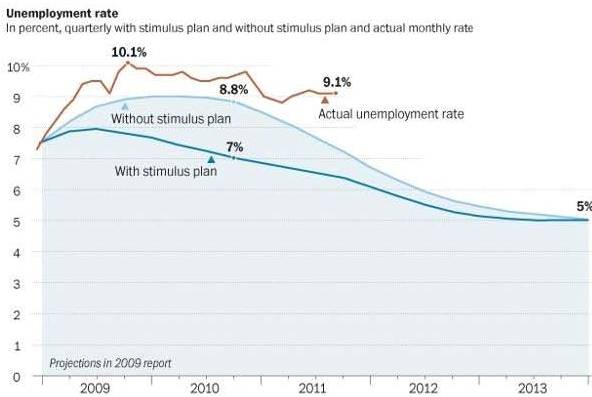

- Fiscal stimulation through increases in public spending does not work empirically. Based on empirical cases from the past the estimated multiplier in modern macroeconomic literature is well below 1 (i.e. for 1 borrowed euro the state cannot buy even one euro GDP growth). The multiplier is achieved through a fiscal stimulus through tax cuts only. But to let you know that lower taxes, which do not press the producers of values - private sector, will lead to economic growth, you do not need the Keynesian theory of fiscal stimulation. The Irish economy is growing despite huge cuts in public spending and catastrophic predictions by Krugman. Or see the evolution of unemployment in the U.S. (red curve) after a massive fiscal stimulus. It is worse than U.S. officials predicted for the case when nearly 800 billion dollar package would not pass (light blue curve).

- The economy is not GDP and tautology GDP = G+C+I+(X-M) should be taken with caution. The strength of the economy is not defined just by the GDP - that is what passes through corporate accounts for the year, but the entire capital structure standing behind this production and not visible in GDP. If you now eat all the grain in the economy, although you will have a higher GDP, but tomorrow you will have nothing to plant. It is also about the quality of GDP, what it comprises, not only its absolute level. Unreasonable expenses with no market rate of return in the frame of the state programs despite the increase of GDP rob the society. They are not investments, but unnecessary consumption and waste of capital. If we connect Upper Mariková with Uzhorod with six-lane motorway (for Slovak prices) we will have high GDP and a nice, long, empty tarmac landing strip (for for example aliens), but in few years we will have nothing to eat.

- „In the long run we are all dead. “ Well, what shall eat those who will come after us? We can see today where buying a miserable GDP growth for the huge public debt leads. In response to the financial crisis there was a massive fiscal stimulation, after which we stayed with slowing economy, huge debts, for which now states are getting into bankruptcy. Today we live in this above-mentioned long-term run when we were expected to be long dead already. Keynes forgot to tell us from whom the states should borrow in case the whole world wants to borrow.

Recommended bibliography

Alberto F. Alesina, Silvia Ardagna: Large Changes in Fiscal Policy: Taxes Versus Spending

http://www.nber.org/papers/w15438

Olivier Blanchard and Roberto Perotti “An empirical characterization of the dynamic effects of changes in government spending and taxes on output”,

http://www.vwl.uni-mannheim.de/fakultaetsseminar/papers/perotti.pdf

Christina Romer a David Romer “The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks,”

http://elsa.berkeley.edu/~cromer/RomerDraft307.pdf

Robert Barro: Goverment Spending Is No Free Lunch

http://relooney.fatcow.com/0_New_4441.pdf

Bastiatov Klam rozbitého okna

http://sk.wikipedia.org/wiki/Klam_rozbit%C3%A9ho_okna

http://bastiat.org/en/twisatwins.html

Krugmanove volanie po bublinách

http://stefanmikarlsson.blogspot.com/2010/04/keynesian-monetary-policy-needs-bubbles.html

Fiškálna stimulácia v praxi

http://www.thedailyshow.com/watch/thu-september-15-2011/that-custom-tailored-obama-scandal-you-ordered-is-finally-here

Comments

2 comment(s). Display all comments.

Dobrý deň.

Fiškálna stimulácia áno, ale len ako pomalšie “vankúš” dosadnutie na pomyselné dno recesie. Aby to nemalo momentálne veľký vplyv na zamestnanosť a veľký skok do recesie. Toto “dotovanie” čo sa deje v Európe už by malo skončiť.

Ďakujem.

Juraj s týmto jediným nesúhlasím : Ak by sme spojili šesťprúdovou diaľnicou (pri slovenských cenách) Hornú Marikovú s Užhorodom mali by sme síce vysoké HDP a peknú, dlhú, prázdnu, vyasfaltovanú pristávaciu plochu (napríklad pre mimozemšťanov), no za pár rokov by sme nemali čo jesť.

Nie sme schopní ani po dvadsiatich rokoch prepojiť Bratislavu s Košicami, nieto s Užhorodom. Je dokázané, že návratnosť diaľnic je omnoho vyššia (multiplikátor cez 1)-samozrejme dvojprúdovú a za reálne ceny.