- The original definition of inflation is the growth of money supply. Gradually, the definition has changed and nowadays the inflation is defined as its result – rising prices.

- This definition is rather problematic; it passes the attention from the cause of the inflation (the change of money supply) to its visible results. At the same time, it is problematic to measure the inflation through inflationary indexes. Something as a price level does not exist. The process of inflation is therefore not very well caught by arbitrary baskets of prices as they are easily to be manipulated by the one who compiles them. The wrong attention to consumer inflation led in the last decade to the fact that central bankers in the times when the biggest bubble in estates in the history was rising in front of their eyes and which was caused by inflation, they spoke about “stable period” or “the time of great moderation” thanks to their enlighten policies.

- In the system of private money production, where money is covered by a commodity, number of money units is limited by the offer of this commodity.

- The offer of gold rises historically in the pace of app. 1 to 2% annually. This is less than increase of productivity in the economy. Therefore, the natural situation in a market environment is price deflation.

- The deflation nowadays is considered to be a negative phenomenon. It is said that there is a danger to postpone the consumption interminably – deflationary spiral, rigid wages, collapse of economic activity, rise of unemployment.

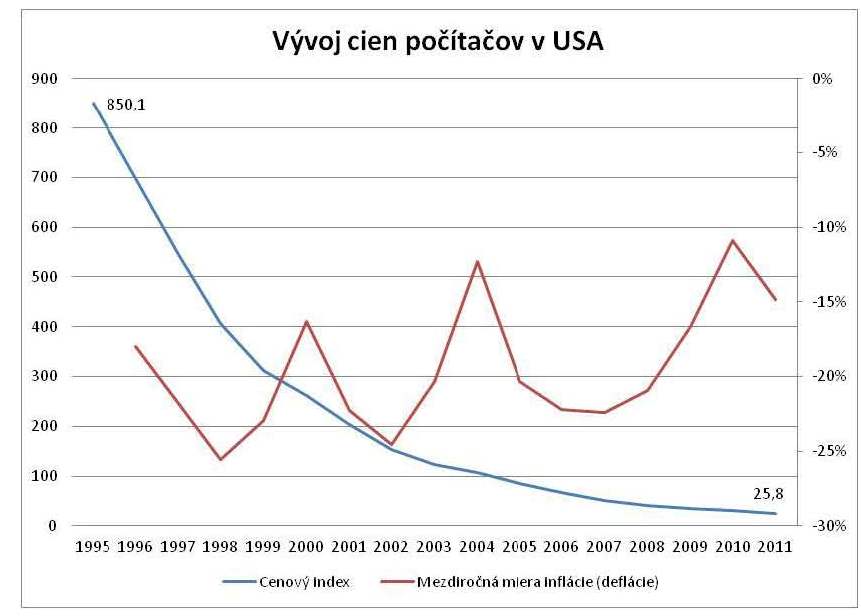

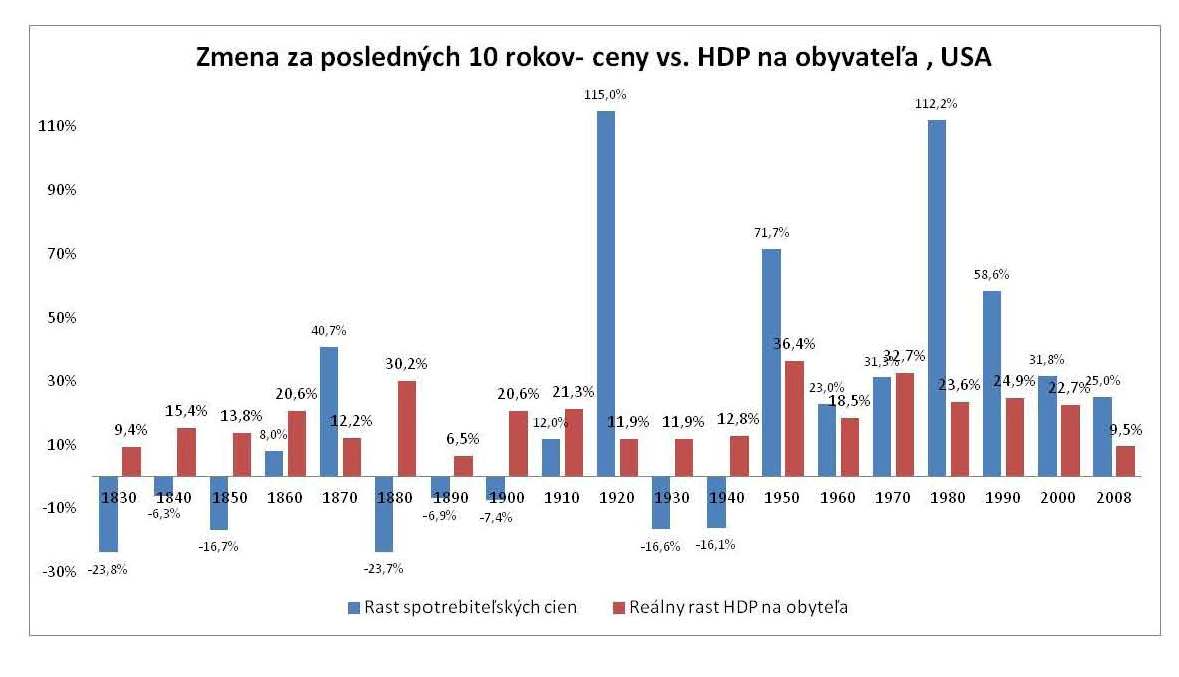

- The price drop caused by the productivity rise which was faster than rise of money supply is a natural phenomenon which does not have any negative effects on economy, contrariwise, people can save their money without worries to lose the buying power of their savings, and they are not forced to take risk on the markets which their do not understand (as it is today, when a common person is forced to invest to prevent their savings from being devalued by inflation). Decreasing prices do not mean slow economic rise, just look at the history of the USA. Important is not nominal but real profit of a saving person. Before the establishment of American central bank, the deflation was a natural phenomenon and during the periods of rapid prices drop GDP per inhabitant rose faster than it is today (between 1870-1880, real GDP per inhabitant rose about 30% despite the fact that during the same period, the consumer prices dropped in the USA about 24%). Decreasing prices did not murder computer industry which was flourishing, based on the economy rise, and it was overtaking the inflation rate produced by central banks. It is flourishing despite the fact that the prices there dropped in 16 years about 97%.

Source: Bureau of Labour Statistics

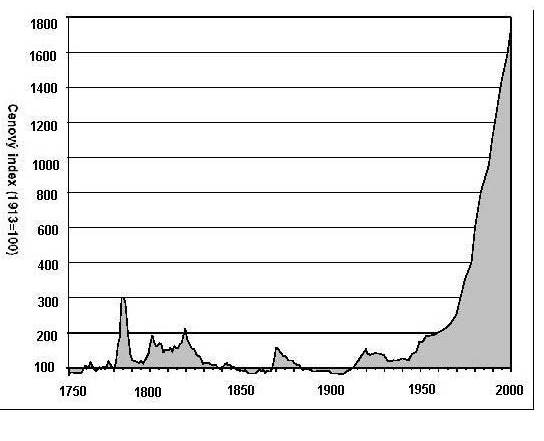

Rising prices are not a condition for economic growth – nor theoretically neither empirically (take notice of prices rise in the decade after establishment of American central bank in 1913, this monetary illusion led to the Great depression in 30s of the last century).

Source: Minneapolis FED, Historical Statistics of the World Economy: 1-2008 AD

- Because of the worries from the deflationary spiral, the central bankers “fight” against any prices drop by producing new money units.

- The opinion, which considers any price deflation to be bad and leading to the economic decline, replaces two types of deflation – already mentioned price deflation arising from the productivity growth, and deflation which results from the monetary illusion and following recession which leads to the breakdown of banks and to the loss of money units in the system – this is a characteristic feature of today´s system of monopoly production of non-covered money or fraction reserves of commercial banks (see Previous lectures). This fluctuation in money supply would be removed by connecting money with a commodity and repeated privatization of its production.

- In the time of rise, the debt rises rapidly and this way also money supply. In the time of recession, the opposite process occurs and against which central banks try to fight.

- This fight takes places as well today. The central banks have under their control only reserves – the monetary money. The commercial banks must do multiplication the way they provide credits for real economy. Nowadays the insolvent banks do not want to do so and they hold the reserves in the accounts in central banks and cover their backs by this money. This money does not affect prices in the system as it does not enter into economy. So it is very difficult for the central banks to produce inflation despite the fact they rose considerably the size of monetary basis. Therefore they agreed with the policy of direct purchase of assets – quantitative easing (QE).

- These reserves of commercial banks could be considered to be filled inflationary dam which is waiting for its releasing to economy and above which the central banks have only limited control.

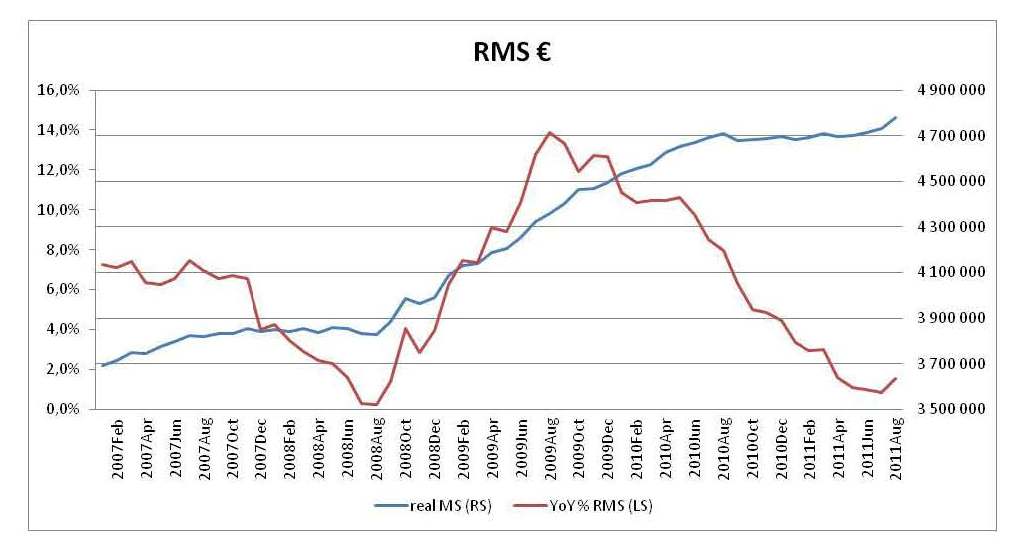

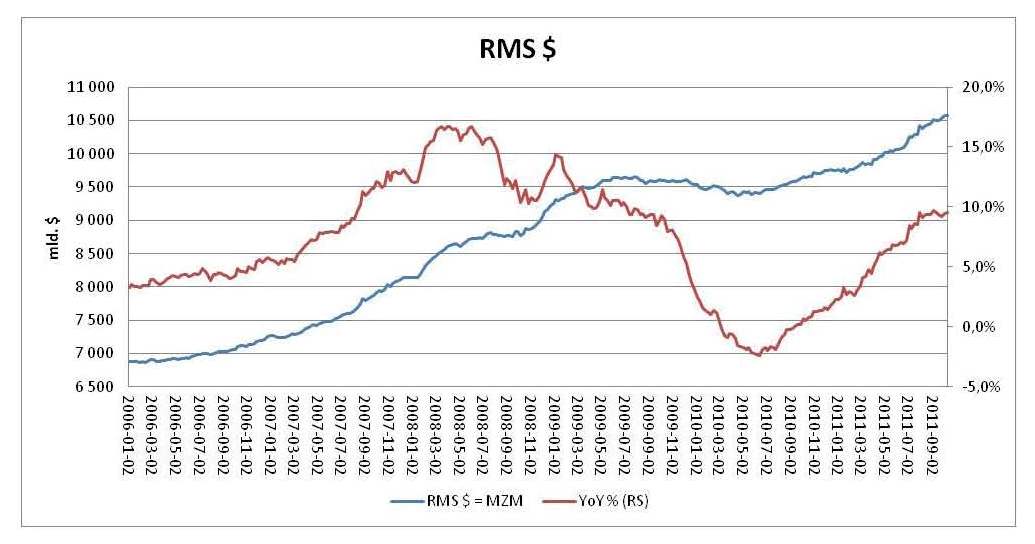

- From the point of view of expansive monetary policy, the inflationary central bank is the FED which within the programs of QE has already bought more than USD 2 billion of assets. The ECB is more conservative which is connected with problems of coordination of different interests of euro-area countries and strong German resistance to inflationary policies. This difference is also visible on a development of money supply. While the amount of dollars in circulation has been recently increasing about 10% annually, the money supply in EMU has been stagnating for a year. This development explains a relative power of euro to dollar despite existential problems of euro-area.

Development of money supply in the euro-area (indicator M1)

Source: ECB

Development of money supply in the USA (indicator Money Zero Maturity)

Source: FED

- In regard to the amount of debts of countries (states are the biggest debtors) and the fact that these countries have control over the real value of these debts, it is possible to expect high inflation in next period. To decrease the real value of debt through inflation is an easier solution than to increase taxes or decrease pensions. Moreover, people usually do not understand the process of inflation and they blame a petrol station attendant, seller or petroleum tycoons from the Middle East for rising prices.

- The constant price inflation is relatively modern phenomenon – it came through monopolization of production by state – a foundation of American central bank FED in 1913.

Recommended bibliography

Reč guvernéra americkej centrálnej banky, ktorý hovorí o príchode nových stabilných časov vďaka osvietenej monetárnej politike:

http://www.federalreserve.gov/boarddocs/speeches/2004/20040220/default.htm

Študijný sprievodca Mises.org k tejto téme:

http://mises.org/literature.aspx?action=subject&Id=11

Comments

4 comment(s). Display all comments.

potreboval som potvrdenie so školy pre pracu ako ziskat

Dnes mame v ekonomike problem, ze mame cenovu inflaciu, ale mzdovu deflaciu….a tak realna ekonomika pada dole…:(

Dakujem za vybornu prednasku. Velmi ocenujem pouzitie grafov v prepise prednasky aj s odkazom na zdroj informacii a takisto odkaz na odporucanu literaturu!

Treba uprimne priznat, ze toto bola vyborna prednaska. Pan Karpis v nej suhlasi s deflaciou a teda sa uz zacina zahravat s myslienkou, aby sme sa vratili zasa k systemu, v ktorom su komoditne kryte peniaze a teda aby sme predisli vsetkym buducim krizam.

Nie je to zly napad… A mozno by to vobec nebola ani taka velka katastrofa.