How is it possible that not even after two years since the end of the so called Great recession in the summer of 2009 and billions of dollars in the business stimulation we are once again worrying about the world economy? When not even the unemployment rates managed to decrease significantly since the official end of the recession. The recession fighters haven’t yet managed to save up money after the last raid and we already have to get ready for the next hard times? Possible answers and my view on the ongoing debt crisis in the Euro-zone will be introduced in the following lectures. I’m the co-founder and analyst of the INESS institute.

If you ask three holders of the so called Nobel prize in economic sciences about the Great recession they will give you four opinions. And this even thought none of them have foreseen this economical crisis, the greatest since the second world war. Considering this variety of opinions about the causes of the crisis and especially the inability to foresee the effects of the changes in the economy it is necessary to be very careful about the acceptance of the solutions they propose. Because their theories are being tested on the whole society and its wallets. Sometimes its better to do nothing. But suggesting to do nothing is not something the state pays its economists.

So, why are we under the threat of a recession again? As a praxeologist, I’m the closest to explaining areal fluctuations in the economic activity with the so called Austrian business cycle theory. Not only is it based on stable theoretical ground, but unlike other theories it also nicely fits to the reality that we are witnessing at the moment. The Austrians, as the only economic direction foresaw the crisis.

The money illusion

There’s a saying that behind everything there’s money and that’s true in this case too. The Austrians don’t see the causes of the crisis in the solar activity or in the Keynesian bipolar consumers. The cause of the business cycles is the state monopoly for money production and especially the bureaucratic manipulation of the most important value in business – the value of credits.

Recession- the decrease of business activity accompanied by the liquidation of businesses and an increase of unemployment, is the result of incorrect economic decisions. Naturally, businessmen make mistakes all the time. However these mistakes don’t pile up to a single short time period and aren’t so spread during a normal functioning of the economy.

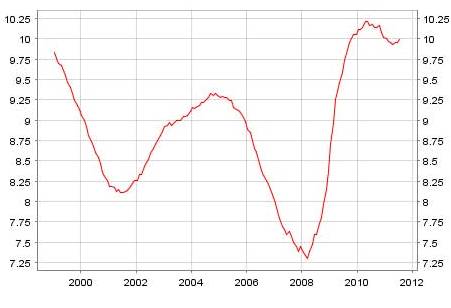

Graph: Unemployment rate in Euro-zone as % of the working force

Source: ECB

But a recession points out a lot of piled up mistakes. How is it possible that many unnecessary houses have been built in the USA? And how, that the businessmen around the world thought that every American citizen will have a Hummer and 5 TVs at home? Who came with the idea that Burj Dubai, a 828 meter tall skyscraper could ever pay off? How is it possible that the banks believed that money from Greece would come back?

The answer is an illusion. The whole world economy lived in an illusion until the recession. A money illusion. The paper money flowing into the economy from central banks was by all mistakenly considered a real capital. This was a horrible miscalculation. Money is not real capital but a token for the existing real capital. The printing of money does not create values, it only redistributes them.

And besides that, it interferes with important information lines of the business actors. That is because money is a part of every transaction in economy. Therefore has their manipulation areal effects -it comes to errors in the economic calculation by which all businessmen operate. Therefore is money the ideal culprit to explain the areal accumulation of mistakes in the economy.

Interest rate is the most important value in economy – and it’s manipulated

As Hayek empathised, market prices are the basic information systems of the economy. Without them no one knows how and what has to be produced, what is rare and what is relatively accessible and how much toilet paper has to be on a shelf at a self-service store in a country with a controlled economy.

Credits value- interest rates are not any less important than the market prices of consumer goods. Because this shows how much of the real capital (savings) is available in a society, more precisely by how long are the consumers willing to postpone their usage into the future and at the same time how much are the investors willing to pay for the borrowed capital.

And now imagine that the interest is not given by the clash of savings offers and investment demand – but a bunch of officers who often thanks to this follow the political goals of their providers. It is interesting that while many economists consider the central fixation of prices of milk to be an absurdity, the central fixation of interest rates, which is disproportionately more important because it doesn’t reflect only in the prices of yoghurt but into the whole economy, is seen as completely normal. A manipulation with interest rates leads to the confusion of a large number of businessmen and a deformation of prices in the economy. On the basis of artificially low interest rates will the builders of Burj Dubai get an excellent return on investment and Americans can even buy a third house on their mortgage. Well of course that the prices of real estates can only grow with such interest rates!

Disillusionment

Artificially low interest rates lead on one hand to a new investment with a long return and on the other hand it leads the consumers to a higher consumption. But who pays for all this? It is the lack of savings – real capital- and disappearance of the money illusion that represents an encounter with the reality. The interest rates will suddenly increase, there is not sufficient money to even finish a skyscraper or to repay a consumer credit for ridiculously expensive unnecessary items (for a watch with waterworks – doslovny preklad). The construction has to be stopped, excessive capacities have to be closed, estates and machinery have to be sold and many unnecessary employees, who have to look for another job, have to be fired. Some banks that based their business model solely on the monetary expansion have to go bankrupt. And we get a recession- the waking from an illusion and the initiation of a healing process so that the economical structure and the public consumption reflected the amount of savings and accessible real capital.

And so in 2008 the world woke up from the money rush. But the healing process of a recession is as painful as a rehab after a rocker youth, and especially for the politicians who don’t have any genes for the communication of bad news with their voters. It’s easier to dream a little longer and that for any price. And so the economy got another immediate stimulation – it came to a radical decrease of the already low interest rates and billions of dollars were poured into the system. These steps weakened the ones who produce values in economy even more at the expense of the ones who consume values. At the same time, the insecurity increased, insecurity about how long these effects of the manipulation will last, and what taxes and monetary politics will await the businesses in the future. Today is the economy waking from the new monetary injection with a bigger headache. In the next sessions we will look at why the monetary drugs are stopping to work and especially at the side effects.

Recommended bibliography

Hayek vs. Keynes prvé kolo

http://www.iness.sk/modules.php?name=News&file=article&sid=2837

Hayek vs. Keynes druhé kolo

http://www.iness.sk/modules.php?name=News&file=article&sid=6199

Bojovníci proti kríze

http://www.youtube.com/watch?v=GzDJqI5c7Rg

„Rakúšan“ Peter Schiff mal pravdu

http://www.youtube.com/watch?v=2I0QN-FYkpw

The Business Cycle Study Guide

http://mises.org/literature.aspx?action=subject&ID=12

Ako vznikajú peniaze – case study zo zajateckého tábora

http://www.albany.edu/~mirer/eco110/pow.html

Crisis Study Guide

http://mises.org/daily/3128

Austrian Theory of the Trade Cycle | Roger W. Garrison

http://www.youtube.com/watch?v=zhoFOyy7rbo

Comments

10 comment(s). Display all comments.

od A do Z suhlas s p.Karpisom…vidiet ze aj tomu rozumie co hovori na rozdiel od p.Vana…dakujem za prednasku

Kto by mal zaujem o moju prednasku, tak nech si ju pozrie na tejo adrese, netreba uz pisat ziaden mail.

FUNGOVANIE STATU A EKONOMICKY AKTIVNYCH LUDI V NOM

http://amaterskenoviny.comule.com/fungovanie.php

Ako odznelo v ČT2:

Ekonómov môžeme rozdeliť do 2 skupín - tí, ktorí nevedia predpovedať ďalší vývoj a nevedia o tom a tí, ktorí nevedia predpovedať ďalší vývoj a vedia o tom.

Kedze moja prednaska je z otvorenej diskusie uz vymazana, tak kto by mal zaujem nech napise mail na .(JavaScript must be enabled to view this email address).

Pri otázke č. 1 som zistil, že už asi prestávam rozumieť slovensky. V prepise prednášky sa píše: “Pritom nezamestnanosť od oficálneho konca recesie ešte významne neklesla.”

Keby tam nebolo to slovíčko “významne” tak mi je jasné, že by mohla byť rovnaká prípadne vyššia, ale keď klesla hoci nevýznamne (pre mňa aj čo i len o “jedného” nezamestnaného), tak je nižšia. A túto moju domienku mi potvrdil aj článok na webe “O PENIAZOCH”

(http://openiazoch.zoznam.sk/cl/110110/Nezamestnanost-v-EU-a-eurozone-medzirocne-klesla) z 31.8.2011 “Nezamestnanosť v EÚ a eurozóne medziročne klesla”. No čo už? Nezamestnanosť sa stále zvyšuje, napr. prpúšťajú hromadne aj v našom podniku, tak samozrejme, že musí byť vyššia. Mal by som si zvyknúť, že zmysel mnohých slov je úplne iný, než som bol zvyknutý a že “významne neklesla” sa nerovná “klesla nevýznamne”, tak ako “čiastočne pretrhnutý” nie je “úplne natrhnutý”.