“Using this instrument governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens in a manner which not one man in a million is able to diagnose.” (Lord John Maynard Keynes in his book "The Economic Consequences of the Peace" (1920)

Mainstream economists perceive the economy as a car that has to be driven, which reacts on incentives by a linear and predictable response. While Keynesians consider the accelerator to be public expenditures, in turn, monetarists consider money supply and interest rate. Both approaches resemble table-knife brain surgery. Let us return to our island economy model so that we can illustrate how monetary stimulation works.

ISLAND MODEL

- Today the number of monetary units - money supply - is controlled by the central bank.

- It produces reserves - cash, and by buying bonds releases reserves into the system.

- Commercial banks due to the opportunities to hold only fractional reserves (in EU only less than 3%) multiply the quantity by the loans granted.

The objectives of monetary policy and monetary stimulation are:

- Stop the money supply overflow caused by bankruptcy or repayment of bank loans,

- Reduce real interest - reduce the savings, increase consumption

- Reduce real salaries and other rigid (sticky) prices,

- Create a monetary illusion of abundance of capital, which leads to economic growth, increase in the prices of financial assets and real estate, tax revenue growth, and apparent prosperity,

- Create the monetary illusion of wealth by increase in asset prices – to increase consumption.

In the first lecture I identified in particular the irresponsible monetary policy, the state monopoly on production of money, and centrally dictated price of loans as the main culprits of errors accumulation in the economy - recession. The process of monetary expansion takes place as follows:

- New money are introduced into the system - reduced by monetary manipulation interest rate causes the semblance of real growth in available real savings, leading to the growth of consumption and investments,

- Low interest rates increase the assets value through lower discount of future income (investors are satisfied with a longer payback)

- A wave of price growth starts in the economy, redistribution of wealth. When the wave ends (in a year or two), effects of monetary stimulation are lost and marginal projects (wrong investments) must be disposed, which would not be profitable at the market price of loans and for which there are no sufficient real savings in the economy,

- Bad investments which cannot be moved into other sectors represent a net loss of wealth for society (e.g. empty homes in the U.S.),

- It is necessary to dismiss people and dispose of bad investments; in case the next round of even more intense monetary stimulation does not start, the recession comes.

Monetary stimulation brings the following negative effects:

- Redistributes wealth in the opposite direction as most taxes - from the poor without assets to the rich and the first recipients of new money,

- damages the savers with inflation, without whom there will be no real savings and economic growth,

- It forces people to speculate on financial markets,

- Levies with inflationary tax,

- It increases uncertainty and leads to errors in business calculation,

- Distorts the capital structure of the economy with unrealistic interest rates (launching more long-term projects)

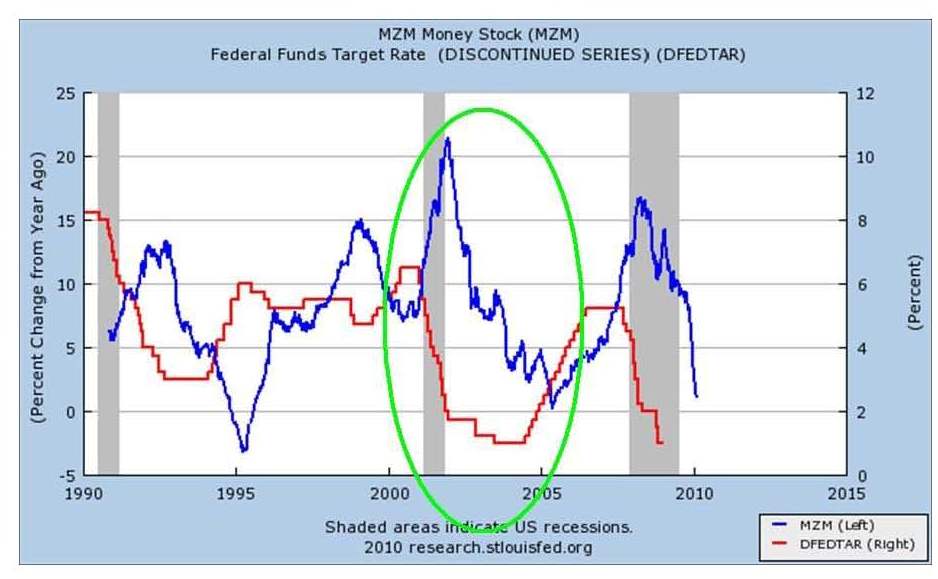

The effect of monetary expansion of the U.S. FED - mega bubble in U.S. real estate market – development of house prices in the U.S. adjusted by inflation from 1890 through Shiller index.

Bubble originated from a dramatic expansion of money supply (monetary aggregate MZM, blue curve left axis, annual% change) after a brief recession in 2001. (Red curve shows the basic interest rate in the United States dictated by the U.S. central bank, right axis).

The central bankers, during the times of not covered by anything, produced by state monopolies money, have become modern-day alchemists who can create wealth from the paper. The whole world flees with hope to these officials who are quite often wrong in predictions of future economic development. The markets are hanging on their lips, to find out when the next dose of opium is going to be injected into the system. Monetary stimulation is still the most popular weapon against the crisis. And despite the fact that the expansion of money supply stood at its beginning. Immediately after the outbreak of the crisis in the U.S. interest rates have been drastically reduced gradually to zero. Once the interest could not be reduced anymore, the U.S. Federal Reserve came to the non-standard measures that increase the likelihood of high inflation. He started a program of so called quantitative easing (QE) in which the Fed began to purchase assets for the reserve money in large quantities. QE1 and QE2 volume together reached 2.3 trillion U.S. dollars. In the first round the Fed was purchasing mortgage securities in particular, in the second the U.S. government bonds. Should the banks use this money for the provision of loans so the multiplication would run, the result could be dramatic growth in money supply and the subsequent high inflation. It has not yet happened and the 1.6 trillion dollars are sitting in accounts of commercial banks at the central bank. The question is till when.

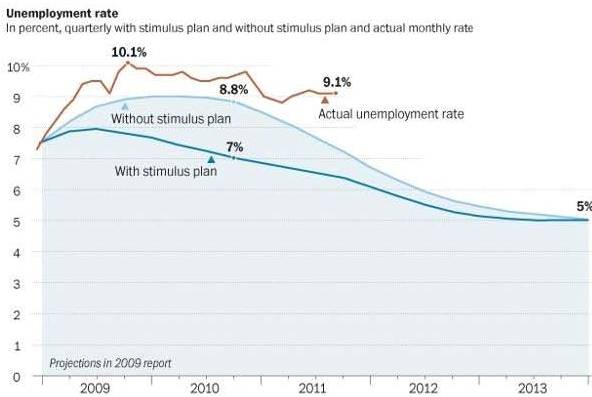

With the help of QE in fact the U.S. central bank paid the U.S. debt with the newly created money. Although the central banks should be independent, at the time of economic hardship, as it is today, they recede and follow the government's fiscal objectives. They help with state funding through monetary expansion. Bonds, although in smaller volumes, began to purchase in May 2010 the ECB as well. Neither QE1 nor QE2, of course did not solve the crisis. Unemployment is still high, the wealth effect from the rising prices of financial assets were enjoyed by the upper few percent of companies and most people have to bear the rising food and energy prices that resulted from these monetary experiments.

Recommended bibliography

Video o inflácii a deflácii pre deti z dielne ECB

http://www.youtube.com/watch?v=pbgY0dYoBvA

Ben Bernanke nemal pravdu

http://www.youtube.com/watch?v=9QpD64GUoXw

Ben Bernanke, August 9, 2005

“There’s a lot of good news on housing. The rate of homeownership is at a record level, affordability still pretty good. [Ed Note: The first part of that statement was true, the second part demonstrably false.] The issue of the housing bubble is one that people have — whether there is a housing bubble is one that people have raised. Housing prices certainly have come up quite a bit. But I think it’s important to point out that house prices are being supported in very large part by very strong fundamentals.” [Ed Note: In fact, it was exactly at this time that we were beginning to see cracks in the housing market as prices peaked in Boston, Detroit, Atlanta and Charlotte.]

Alan Greenspan, September 26, 2005

“In summary, it is encouraging to find that, despite the rapid growth of mortgage debt, only a small fraction of households across the country have loan-to-value ratios greater than 90 percent. Thus, the vast majority of homeowners have a sizable equity cushion with which to absorb a potential decline in house prices.”

Ben Bernanke, March 28, 2007

“At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.”

Comments

1 comment(s). Display all comments.

PREČO NA CELOM SVETE V SÚČASNOSTI CHÝBAJÚ PENIAZE, PREPADLI SA POD ZEM?

http://amaterskenoviny.comule.com/peniaze.html