Money is an interesting phenomenon. Even though every one of us has them in our wallets or holds them a few times daily in our hands, nearly non of us understand how they work nowadays. Since we labelled money as one of the main suspects of the current problems in the economy in the last lecture, lets look at how the financial systems in the world nowadays works. So where and how is money created and what effects does it have on the economy.

Gold as money

Money is a very useful instrument that allows us to divide the exchange of goods in time. But in order for money to do this function properly it has to be rare and able to keep its value in the time between these two exchanges. A thousand year lasting money tender in a fair and compelling global competition of various commodities was in the end won by gold. It is relatively rare and its supply can with an increasing demand rise very limitedly and it’s timely relatively stable. Gold doesn’t subside – gold doesn’t oxidise and even the deepest buried pirate treasure will be sooner or later found. On the other hand, in order to increase the amount of gold you really need a lot of capital and human work. That’s why can gold easily keep its purchasing power and same as hundred years ago you can buy a tailored suit, a trip through the Atlantic in an economy class, a horse or 30 bottles of quality whiskey for an ounce of gold.

The golden dictate

However gold is a uncomfortable limit to the expenses of countries. If you’re a politician and you want to finance a war or presents for your favourite groups you have in a fair golden standard actually only two choices. Increase the taxes- which doesn’t do the politicians popularity any good, or you have to borrow from private investors under by them set conditions. But if you introduce a currency backed by nothing with a forced circulation in your territory, which will be monopoly produced by an “independent” by you founded central bank (history shows that central banks are independent only until they need to get rid off enormous deficits in public funds, see Buiter 2010), you can print your own money for a war with the assistance of privileged commercial banks. And the following increase in prices can be later blamed on the profit hungry businessmen.

The golden standard limits besides the deficits of the public funds also the incomes of commercial banks from interest rates, since the debt can’t expand with the same rate as this happens in a system with currency that’s not backed up. That’s why gold obtained the pejorative name “ barbarian relic” or “ golden cage” from economists favouring a national interference with the economy. Gradually, the influence of the named interest groups made sure that the money production is nationalised and money backed by nothing is introduced, so called fiat money, or in Slovak “willbe” money. As history showed and as we will also see in the following lectures, the politicians really “got loose from their golden chain”.

Divorce from gold

Gold was filling the role of money more or less in a limited extent until 1971 (Great Britain left the golden standard in 1931), when the American president Richard Nixon got scared of the French boats that were coming to the USA after the massive expansion of the paper dollars to exchange them for gold. With this Nixon definitely removed the backing of dollar by gold. And so the paper money got loose from the objective limits of the commodity offer and ended up under the full influence of the state and central bankers. The function of a world reserve currency – so a currency in which all people in the world save up, was taken by the American by-nothing-backed paper dollar. Dollar came to the status of the world’s reserve currency through the strong economy of the USA, abstinence of serious war conflicts on their territory and in the world standard a relatively liable fiscal policy.

A blatant privilege

However this position meant a “blatant privilege” for the USA. This label was used in 1960 by the French finance minister Valery Giscard d’Estaing. Since the dollar is being uncritically accepted by actors around the world, USA could for the price of the production of one hundred dollar bill , which is worth a few cents, buy in the world real goods in the value of 100 dollars. And so many foreign subjects de facto funded the welfare of the USA or their war escapades abroad. However today they are holding paper dollars that are continually loosing their purchasing power and they still don’t want to believe what they’re seeing. For example the dollar reserves of China have reached over 3 billion USD. Even after 30 years is the message from John Connally, governor of FED during the times Richard Nixon was a president, to other countries: “Even though dollar is our currency, it is your problem.” more and more intensive and still valid.

The effects of “willbe” money

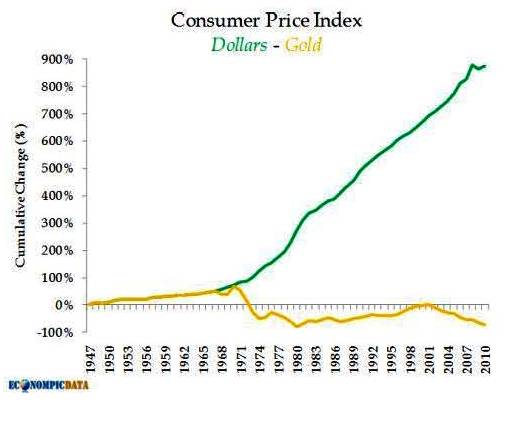

A few days ago we could celebrate the 40th anniversary of the cancellation of the backing of the American currency by gold- the so called golden bankruptcy of the USA. Naturally, if there would be something to celebrate. Judging by the consumer price index development the paper dollar fell completely. The prices of goods and services in the USA have risen since 1947 in paper money by 900%. If we count over the price of the goods and services to units of gold we realise that during the same time they decreased by more than 70%.

Source : ECONOMPICDATA

The difference between the prices plus 900% minus 70% is the increase caused by the inflation of money supply by printing of more money. This inflation helps to finance the national debt, redistributes resources in economy from the last receiver of new money towards the first and so increases the income imbalance. Because the first purchase for prices that don’t yet reflect the higher amount of money in circulation. Enormous fluctuations in the money supply thanks to the banking of fractional reserves and money production of the central bank interferes with the informative value of prices in the economy. Fractional reserves represent for banks the possibility to not hold all money that people deposit to their basic accounts in a safe, and they have the possibility to provide them with further loans. And so comes to the increase of money in the circulation – a so called multiplication by the banking system. An overview of the various organisations of financial systems can be found in the attached table. The creation of new money in the combination with artificially lowered interest rates leads to the accumulation of deceptive investments in economy. The result is besides other effects the biggest recession since the second world war.

The comeback of gold – the golden conscience of central bankers

Today gold is going through a massive comeback. We can also call it the bad conscience of the central bankers. Gold is not a classic asset, but it still fills a monetary function even thought this was completely nationalised by countries 40 years ago. Who says that the purchase of gold by people is irrational, because gold can’t be eaten, forgets that it’s hard to eat Euro bills (and I’m not even talking about the coins) and there’s still demand after them.

And what about deflation? Weren’t we under the threat of lower prices in case of a recurring golden standard? Is there really no need to worry about lower prices? We will get to the threat of deflation in the seventh part.

Additional sources:

|

Financial system |

current Bretton- Woods 2 system |

"gold standard" |

freebanking |

100% reserve |

|

Emission |

emission monopole of the central bank |

emission monopole of the central bank |

competition of private eminents |

competition of private eminents |

|

Possibility of money production by commercial banks |

fractional reserves |

fractional reserves |

fractional reserves |

100% reserves to check deposits |

|

Backing (of reserves) |

fiat = paper, dollar |

gold |

commodity – given by market probably gold |

commodity – given by market probably gold |

|

Characteristics |

extreme volatility of the money supply, interest rate manipulation creates business cycles, support of deficit management of the country, inflation tax, redistribution of wealth |

smaller volatility and business cycles, political limitations of deficits, benefit of a global currency, painful comeback after an inflation excess |

a present, but by competition limited inflation, impossibility of interest rates manipulation and misuse of emission monopole with the goal to finance national needs, tendency to concentrate and effort to create a cartel defender -CB |

discards the licensed status of the banking sector that as the only one can be constantly in the state of an unrevealed bankruptcy (there is a legal right of more people to one property), stable supply of money, interest rate reflects the amount of savings in society, elimination of business cycles, limitations of the deficit management of country |

Recommended bibliography

Comeback of the golden times

http://www.iness.sk/modules.php?name=News&file=article&sid=2179

About the golden standard at CNBC

http://blog.mises.org/18291/cnbc-on-gold/

Keynes celebrates the end of the golden standard “golden cage”

http://www.youtube.com/watch?v=U1S9F3agsUA&feature=player_embedded

The American president Richard Nixon announces the cancellation of the backing of the American dollar by gold and the introduction of the 10% trade tax on imports into USA

http://www.youtube.com/watch?v=iRzr1QU6K1o

About the possibilities of fiscal deficit financing through the use of monetary monopole have a look at i.e. Games of ‘Chicken’ Between Monetary and Fiscal Authority: Who Will Control the Deep Pockets of the Central Ban

http://www.nber.org/~wbuiter/deeplong.pdf

Or also The Debt of Nations

http://www.nber.org/~wbuiter/DoN.pdf

Comments

10 comment(s). Display all comments.

prvá prednáška, myslím, obsahuje príliš mnoho informácií a je pridlhá, druhá je pre mňa stručnejšia, jasnejšia, konkrétnejšia a ako nie ekonóm to vnímam tak, že predsa sa tie doláre kdesi tlačia akosi nadbytočne….

Citate si vobec tie odkazy co Vam posielam? A navyse Vam nestaci multiplikacny efekt? Ved zo 100 korun a zhruba 17 korun, ktore prida banka, sme vytvorili:

1. pan A ma na ucte stale 100

2. pan B si kupil od obchodnika B1 tovar za 90 korun

3. pan C ma k dispozicii 80 korun

dokopy sme teda vyvorili zo 117 korun az 270 korun…

ale uz sa mi nechce hadat, jedine za honorar od UPMS

skuste mi poslat nejaky odkaz, ktory potvrdzuje Vase slova, lucim sa

Pozdarvujem Vas pan Janik.Tento system funguje tak ako som ho popisal,potvrdzuju to aj niektore vyjadrenia poprednych bankarov z minulosti.Nesuhlasim s tym ze vsetci by sme boli bilionari.Prave naopak.Aj v dosledku tohto systemu dochadza k extremnej prijmovej polarizacii.Potom sa niet co divit ze 90% svetoveho bohatstva, vlastni 5% ludi.

Tak o takomto systeme som sa nikde nedocital. Ale viete si predstavit, ze pan obchodnik B1 zanesie do banky 10 000sk a banka z nich 100 000sk pozicia a potom znovu a znovu? Viete si predstavit, kam by tento system konvergoval? Zachvilu by sme vsetci boli bilionari…

Kapitalova primeranost 10% znamena, ze ak pan A vlozi do banky 100 a banka chce 90 pozicat panovi B, tak 10% z 90 teda 9 musi banka dat zo svojich penazi. Pan B teda dostane 81 z penazi pana A a 9 od samotnej banky. A po tejto transakcii zostane banke na ucte 19 od pana A. A aby banka nemohla vsetky peniaze od pana A pozicat, potom je tu este povinna minimalna rezerva, ale ta je len 2%. Lenze, ak by banka chcela pozicat celych 98 od pana A, tak potom by zo svojich penazi musela dat 9,8.

Tu je to tak trochu vysvetlene

http://referaty.atlas.sk/vseobecne-humanitne/nauka-o-spolocnosti/26847/regulacia-bankovych-obchodov

Pekny podvecer pan Janik.Ano Vy ste popisali ucebnicovy Multiplikacny efekt z Makroekonomie.Ten vsak realne nefunguje tak ako ste ho popisali.Funguje nasledovne.Banka otvori vrata prvy den,pride klient A ktory vlozi 1000sk.Banka vzhladom na to ze ma vklad vo vyske 1000sk moze poskytnut uver vo vyske 10 000sk.Preco?Pretoze splna kapitalovu primeranost 10%.Ma rezervu v sume 1000sk (teda vklad) co umoznuje banke poskytnut uver panovi B v hodnote 10 000sk.Banka poziciava 9000sk ktore nema.O tychto peniazoch hovorim.