In last week's lecture we briefly explained the emergence of eurocrisis and its progress in the case of Greece.

Ireland is another country that about half a year after Greece, in November 2010, asked the EU for help from the European Financial Stability Facility (EFSF) created in the meantime for this purpose. As to the level of credibility in the eyes of financial markets, therefore, Ireland got into a very similar situation as Greece, but on other grounds.

As we have seen in one of the UPMS first trimester lectures, Ireland was a shining example of success, from the poorest country in Western Europe it got onto the second place (after Luxembourg) of economic level (GDP / capita). During the starring years 1990 – 2007 its real GDP increased fourfold and employment doubled. Then came the global financial and economic crisis and hit Ireland much stronger than other EU countries. Why?

There were two sources of this rapid growth in the years 1990 - 2007. The first, which was dominant until 2000, was the growth of real competitiveness, productivity and export performance, mainly given by convergence, reforms, integration and significant inflows of foreign investments. Thanks to a healthy and sustainable growth around the year 2000 Ireland reached the level of rich and developed Western European countries and it was expected that Irish economic growth will ease and get the growth rates of these countries. It did not, Ireland continued to grow significantly faster, in principle by the same pace as previously, about twice as fast as countries it caught up in the meantime. A source of the excessive and artificial growth was largely a real estate bubble, financed by bank loans. So it was a similar problem as in the USA.

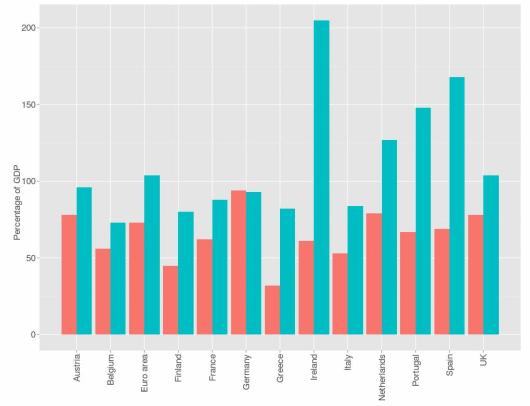

The chart shows the unprecedented size of the real estate bubble as follows:

Chart 1. Bank loans to households and non-financial institutions as a percentage of GDP between 1999 and 2008

As seen from the chart, in Ireland the volume of bank loans in these years (1999 - 2008) increased from 60% of GDP to more than 200% of GDP, a large proportion of these loans went to real estate market, i.e. the new buildings. On the second and third place in the growth of loans Spain and Portugal are placed and this is also one of the reasons for their current problems.

In Germany the volume of loans to GDP even decreased slightly over the same period. In the extent of this bubble, we must realize that it is a pointer to the GDP in ten years and during this period Irish GDP grew about twice as fast as the average in Western Europe. It was really a gigantic bubble.

The rate of bloated real estate bubble in Ireland is shown also by increased house prices. While in 1997 the average new apartment price was three times the annual average income, in 2006 it was nearly ten times the annual average income. In 2007, on top of the bubble, Ireland built half the number of new homes comparing to the UK, which has 14 times bigger population than Ireland. In Ireland at that time 13% of all employed were working in the construction industry, which was more than twice the area average. In 2007 the bubble burst, building industry had almost stopped, construction industry and banks were in very serious trouble. The mechanism of a bursting real estate bubble can be found in the second trimester lectures of UPMS.

Irish banks which lent huge amounts to developers and speculators with land were in serious trouble. The government, fearing the onslaught of depositors, guaranteed one hundred percent of the population deposits, which put a significant part of bank risk on the shoulders of the budget. The Irish government took over banks' bad loans for 40 billion euro and poured 30 billion euro of new capital into banks, a total of about half of GDP, but the situation still remained poor. The problem is also in the fact that refinancing of the Irish banks on the international markets is about half much more expensive than their revenues from domestic loans.

All of this also led to a marked increase in public debt. Ireland had previously accustomed to high income growth and increased income taxes over the years while public debt and deficit were low. In the years 2007 - 2009, however, tax revenues fell down by 20%, while expenses increased by 9%, for example, due to unemployment increase threefold to 13% level.

During autumn of 2010, the situation in the Irish banks escalated further and the government decided to save them by borrowing money from European Financial Stability Facility. Amount of loan is 85 billion of which 22.5 billion euro are funded by the IMF.

Ireland was given total support of 85 billion euros as follows:

a) European Financial Stability Mechanism (EFSM) - 22,5 bil. euro

b) European Financial Stability Facility (EFSF) - 17,7 bil. euro

c) UK, Sweden, Denmark - 4,8 bil. euro

d) IMF - 22,5 bil. euro

e) Ireland (contribution from reserves of cash and the National Pensions Reserve Fund) - 17.5 billion euro

The public finances deficit reached an astronomical level of 32% of GDP in 2010, mostly (19% of GDP) the non-recurring costs to save Irish banks. Public debt has exceeded 100% of GDP in the year 2010, while it stood at 32% of GDP on average in 1999 - 2007.

And what was the role euro played in all this in Ireland? Apparently quite important. Low interest rate increased the availability of easy money and easy financing of estate boom and thus helped inflate the bubble. Bubble in Ireland started to blow just upon the creation of the euro area and in this period (2000 - 2007) the salaries grew by 40% over the level of wages in business partners which led Ireland to lose its competitiveness. For example, in comparison to Germany Irish real wages grew up during the years 1999 - 2009 by 37.4%. Now of course there is problem that the euro prevents this disproportion from being dealt in a simple way – by devaluation.

Despite the fact that Ireland became the second country to get into serious problems after Greece and had to ask the EU for help, the Irish story is different from the Greek. Ireland got into trouble mainly because of the huge real estate bubble and the consequences that it had left in the banking sector. Ireland is also an evidence of how devastating a failure of banks can be and how politicians, but ultimately taxpayers, become hostages to the banks and the nowadays banking system.

More about this in the next lecture.

Comments

2 comment(s). Display all comments.

červená kravata?? :o

5:55 nie veritelia , ale Dlžníci prestali splacať peniaze , kt. dlžili bankám.

Samozrejme tu nechcem kritizovať nejaké malé chybyčky .

prajem príjémné sledovanie

prajem príjémné sledovanie

Tieto prednášky sa mi veľmi páčia a dozvedel som sa v nich mnoho nových informácií.